estate tax changes in 2025

Standard deduction starting in 2018 was 24000 for married persons filing jointly 18000. Estate Tax Exclusion Changes Now and in 2025.

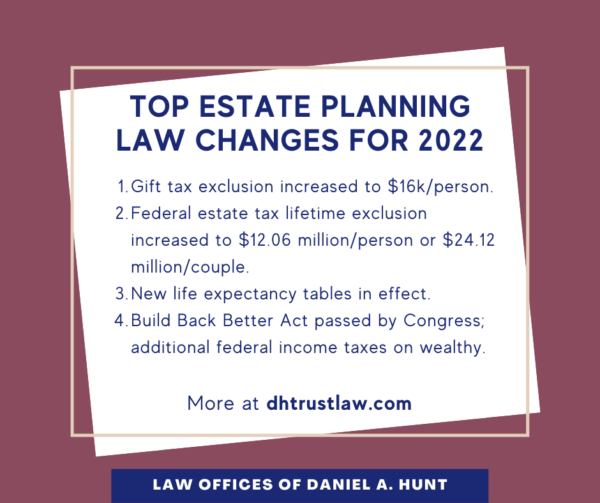

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

The estate tax is imposed on bequests at death as well as inter-vivos during life gifts.

. HOW TO PAY PROPERTY TAXES. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. See what makes us different.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. With indexation the value was 549 million in 2017 and with the temporary. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated tax burden. When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65 million. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per.

The law also changed standard deduction. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. This is the amount one person can pass gift and estate tax free during their life or upon death.

Annual change in K-12 school performance over last 5 years. See details for 11 Frances St Piscataway NJ 08854. This is a substantial means of compounding estate tax savings.

A certain amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the federal government. 2021 Q4 - 2022 Q1. View property data public records sales history and more.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. This increase expires after 2025. Ad Fisher Investments has 40 years of helping thousands of investors and their families.

With proper trust provisions a married couple could pass 2412 million. This is the amount one person can pass gift and estate tax free during their life or upon death. These changes were instituted by the IRS.

City of Jersey City Tax Collector. That could result in your estate having to pay over 49 million in federal taxes leaving your heirs with about 1474 million in after-tax assets rather than 1964 million if you made the gift sooner. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

In Person - The Tax Collectors office is open 830 am. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

By Mail - Check or money order payable to. 280 Grove St Rm 101. 10 24 35 and 37.

Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. 2021 Q1 - 2022 Q1. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

The annual amount that can be gifted each year without reporting is now 16000 for an individual and 32000 for a married couple. 2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

The average effective real estate tax rate is based on the median real estate taxes paid in the neighborhood as a percentage of the median home value in the neighborhood. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The estate tax exclusion has increased to 1206 million.

Additionally there are four tax rates for estates and trusts. The Treasury Department and the IRS issued proposed regulations which implement. We dont make judgments or prescribe specific policies.

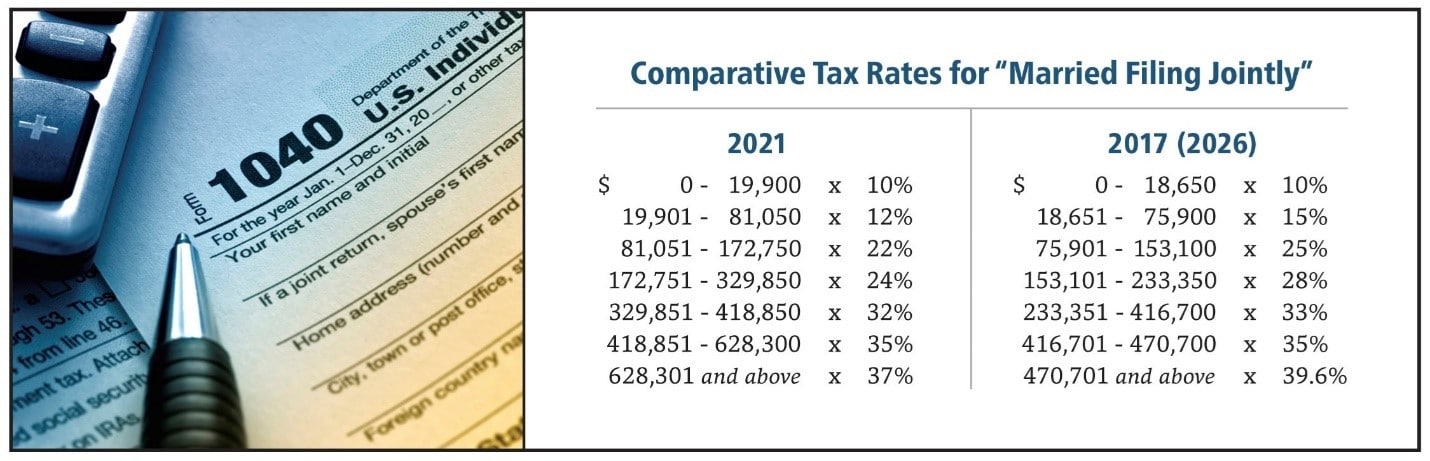

WASHINGTON Today the IRS announced that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. With proper trust provisions a married couple could pass 2412 million. Currently there are seven different tax rates for individuals the lowest being 10 and the highest falling from 396 to 37.

How Did The Tcja Change Taxes Of Families With Children Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How The Tcja Tax Law Affects Your Personal Finances

What Are Estate And Gift Taxes And How Do They Work

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation

How The Tcja Tax Law Affects Your Personal Finances

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)